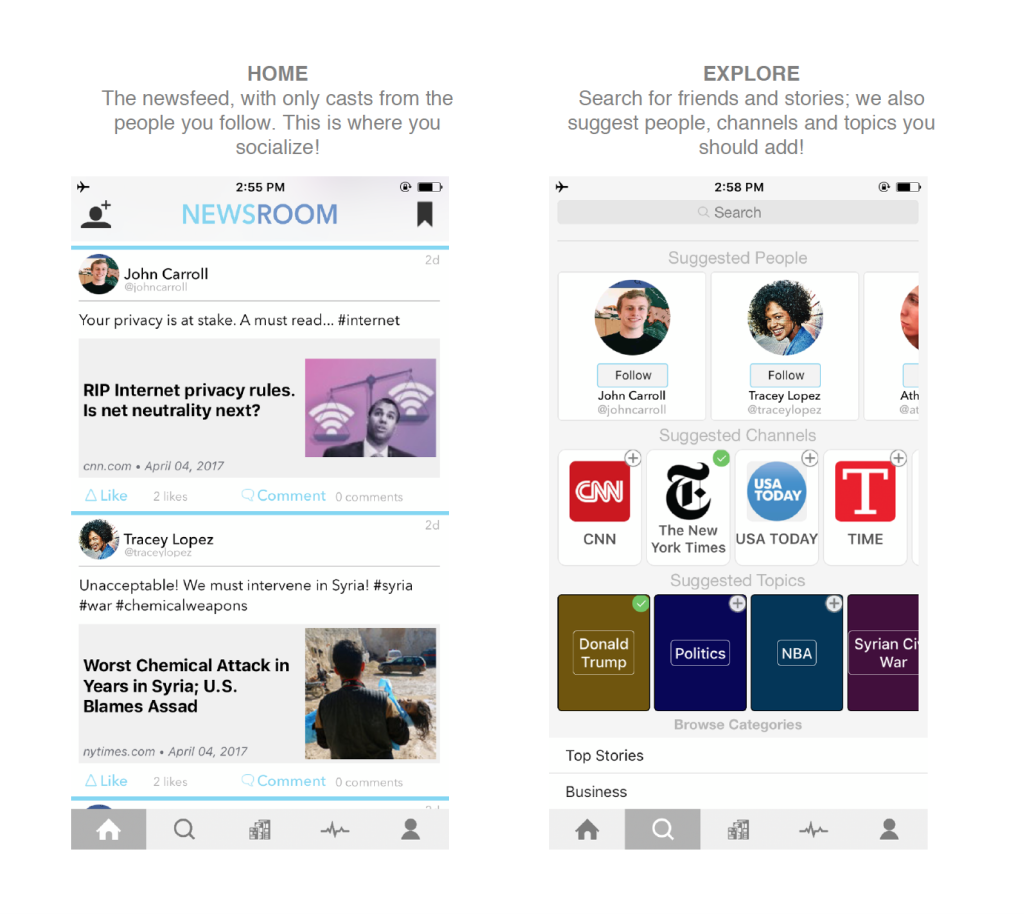

Hans Claessens (MSB ’14) talks with MSB professor Lynn Doran. Claessens spent this summer at Goldman Sachs in New York City.

“I spent the summer working on Wall Street” likely conjures images of posh offices, nights out in the city and weekend getaways with the bosses. Yet while the pay is good and prospects of full-time employment are enticing, interning on Wall Street is no vacation.

Zach Zimmerman (MSB ’14) — who worked at Barclays in New York City this past summer — said he worked 43 straight days, taking off only two Sundays during his 10-week internship. Hans Claessens (MSB ’14) said he logged 120 hours some weeks in his office at Goldman Sachs, leaving work on occassion not long before some of his colleagues arrived.

Wall Street internships are incredibly competitive, and many interns quickly find themselves working alongside senior analysts on projects involving huge sums of money. Although the hours are difficult, interns say bosses rarely are pushing part-timers to the breaking point as a test of commitment.

“You’re going to work your butt off and learn a lot,” said Christoper Kenney (MSB ’14), an intern atHoulihan Lokey’s Washington, D.C. office.

With some interns clocking 18-hour work days without days off, internships are a crash course for what some will experience if they do land a job on Wall Street. That workload is typical for entry positions, and sometimes interns find themselves working alongside company vice presidents at 3 a.m.

“It’s a sprint, not a marathon,” Zimmerman said. “You need to know your limits.”

Earlier this month, an intern at Bank of America working in London was found dead in his shower after reportedly working three straight days without sleep and eight sleepless days over the previous two weeks. The British paper The Independent also reported that the Bank of America intern was also epileptic, which may have contributed to his death.

Nevertheless, that story has brought into question working conditions for those interning at large banking firms, where some bend over backwards to make an impression. Getting the internship is a feat in itself; at Goldman Sachs, 17,000 students from around the globe applied for just 250 openings.

While many people reel at the thought of sleep deprivation in the name of banking, many of those interviewed said that the work is not meant to be backbreaking. Isaac Freedman (MSB ’14) said he was encouraged to take breaks to go to the office gym while interning this summer at Credit Suisse.

Sleep, however, is indeed in short supply at many of these offices. Kenney noted that recent hires atHoulihan Lokey would spend nights in the office, take short one- to two-hour naps and get back to work.

“It’s not for the faint hearted,” Zimmerman said.

While banking analysts tend to stay in the office until late into the night, Nicole Trawick (SFS ’14) — who worked as a securities analyst for Goldman Sachs — found herself with shorter hours yet an equally dynamic work environment.

“You need to demonstrate that you prepared on your own,” Trawick said.

Trawick noted that while she was out of the office by nine in the evening on most days, she was still expected to spend time studying the job off the clock.

Claessens, who worked with healthcare investment banking at Goldman Sachs, said he was exhilarated by the work he was given.

“Consulting and investment baking jobs give you exposure that you wouldn’t get at another job. You’re exposed to the largest companies in the world and billions of dollars in transactions and you’re able to put to use the things you’ve learned at Georgetown,” Claessens said.

Claessens also noted the benefit of the Georgetown network at Goldman, where roughly 90 alumni work throughout the company.

Trawick was also quick to point out the accessibility of senior level employees and the level of professionalism at the firm.

“It’s like the first day of college,” Trawick said. “You can go up and talk to anyone.”

While the firm’s employees were accessible, the amount of information the interns were expected to know was daunting. “It’s like drinking from a fire hose,” Zimmerman said.

According to many of those interviewed, legend of cutthroat co-workers are largely mythical. Freedman likened the camaraderie between his fellow interns to the bonds formed in a fraternity pledge class.

Although interns found the office environment supportive, the work is nonetheless grueling. “It one thing to think you’re going to work long hours, it’s another thing to do it,” Kenney said.

Yet as some interns found out, there’s light at the end of tunnel.

“It’s definitely a celebratory moment to know that I’ll be financially independent after my parents spent $50,000 a year for me to go to Georgetown,” said Claessens, who accepted an offer this week to work at Goldman Sachs after graduation.