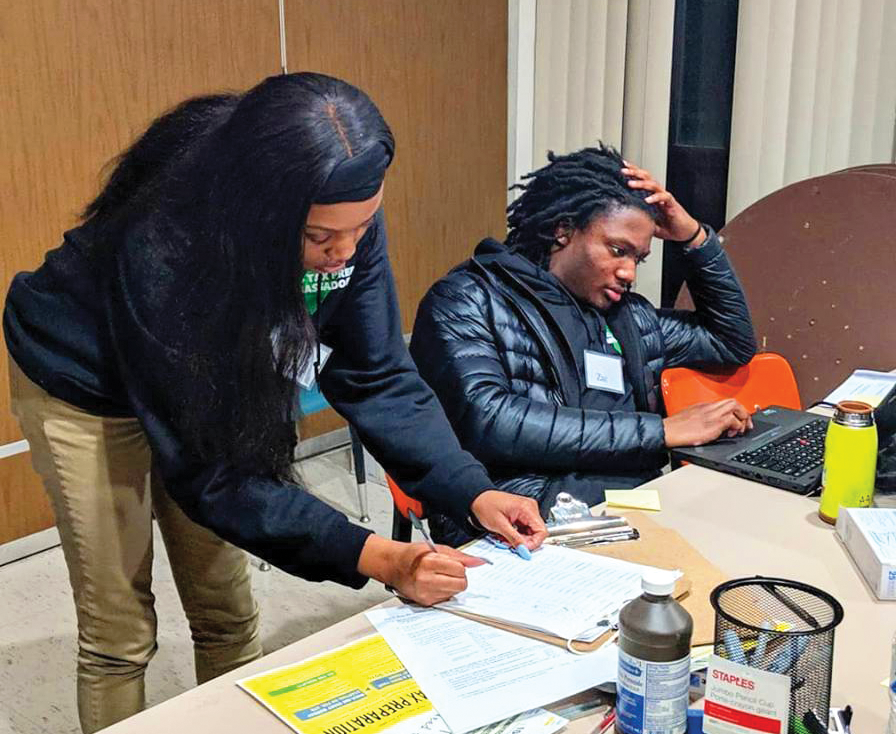

Peter Nouhan (GRD ’19) started a new program that trains high school students for free to file taxes on behalf of low-income individuals in Washington, D.C., primarily within Ward 7.

Nouhan founded SEED Tax Prep Ambassadors after receiving the 2018 Baker Innovation Grant, a $20,000 grant to fund social and political programs founded by graduate students from the Baker Center for Leadership and Governance, within the McCourt School of Public Policy.

The program trains students at the SEED Public Charter School of Washington, D.C., a local public charter boarding school in Fort Dupont, to help their community members earn tax refunds.

So far, high school volunteers from the program have assisted over 70 people in filing their taxes, nearing their goal of helping 100 clients this season.

Low-income earners often miss opportunities for saving when they file their taxes, according to Nouhan.

“The earned income tax credit is one of the biggest social welfare programs that’s hidden in the tax code,” Nouhan said in an interview with The Hoya. “So many people in D.C. alone aren’t taking advantage of this program because they don’t have access to affordable, quality tax preparation.”

The federal earned income tax credit, created to benefit workers with low to moderate income, provides tax refunds and may lower the amount of tax owed for those who qualify and file a tax return.

The median household income for Fort Dupont, the neighborhood surrounding the SEED Charter School, is $34,487, and the national poverty line for a household of three is $21,330.

The program was developed with the help of Hoya Taxa, a Georgetown student-run tax assistance program founded in 2013 that offers free tax assistance to low-income communities throughout the District, according to Daphne Chiang (MSB ’19), a member of the Hoya Taxa mentorship team.

“Peter wanted Hoya Taxa to help out as much as possible, and since this program was so new, he was very open to ideas,” Chiang wrote in an email to The Hoya. “Peter did not have experience filing taxes or with Community Tax Aid, and looked to Hoya Taxa members’ experiences to get a better idea of the filing process.”

Since traditional tax filing can take up to three hours, volunteers use a “Drop-Off” model currently used in Detroit and New York, which allows a client to spend only 20 minutes filing taxes, according to Nouhan.

High school volunteers are trained and certified to handle the tax documents, which includes intaking the client’s information including tax documents, photo ID and social security card, and uploading them to a secure Google Drive. A certified public accountant then prepares the taxes remotely. The client returns a week later to go over their return, then everything is submitted to the IRS, according to Nouhan.

The training got easier over time, but some volunteers questioned their participation in the program after the work increased in complexity, according to Kendriss Johnson, a member of the SEED team.

“The training was challenging in the very beginning,” Johnson said in an interview with The Hoya. “I was like, ‘Do I really want to do this? Will I understand how to do this?’”

Hoya Taxa will provide a foundation for the Tax Prep Ambassador program’s future, according to Luisa Boyarski, the Assistant Director of the Center for Public and Nonprofit Leadership at the Baker Center.

“While Peter will be graduating this year, Hoya Taxa will be stepping to to lead the work with the high school students, creating meaningful mentorship opportunities that can have important impacts beyond tax preparation,” Boyarski wrote in an email to The Hoya.

The Tax Prep Ambassadors program can serve as a model for similar programs across the country, according to Boyarski.

“By engaging both high school and college students in this work, Peter’s model is helping educate the next generation before they have to file their taxes for the first time,” Boyarski wrote.

Volunteering for SEED has been a rewarding experience because of its contributions to the Seed Charter School community, Johnson said.

“The most meaningful part is knowing that I’m helping people in the community,” Johnson said. “There aren’t a lot of people that can say they helped someone do something that’s so stressful, so I’m just happy to help anyone who needs it.”