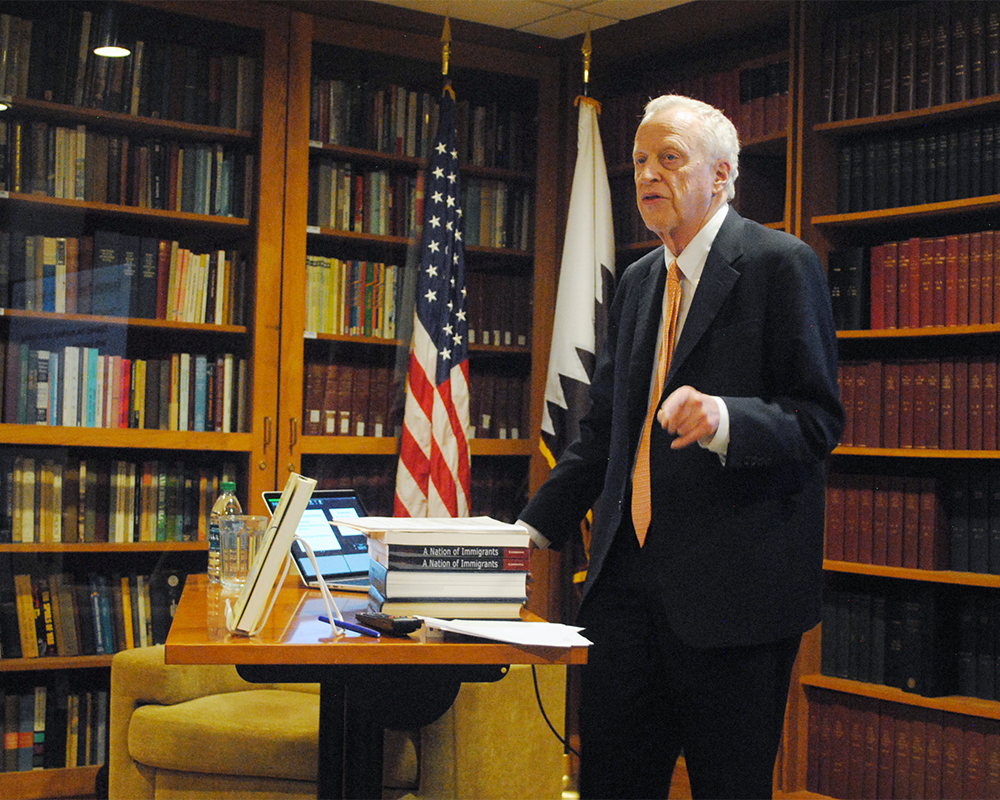

Professor George Akerlof, winner of the 2001 Nobel Prize in economics, spoke about his new book, ‘Phishing for Phools,’ the dangers of the free market and the benefits of deregulation at the Carroll Round’s second Professor Speaker Series in the McGhee Library.

Professor of economics George Akerlof, the winner of the 2001 Nobel Prize in economics, emphasized the dangers of free markets for consumers and the importance of deregulation in the 2008 financial crisis in a discussion of his new book, “Phishing for Phools,” at the Carroll Round’s second Professor Speaker Series in the McGhee Library on Thursday.

According to Akerlof, “Phishing for Phools” contradicts conventional economic theory, as it argues that no one benefits from making others suffer only in equilibrium, which is difficult to achieve in reality.

“With completely free markets, there’s not only freedom to choose, there’s also the freedom to ‘phish,’” Akerlof said. “It will still be true that the equilibrium is Pareto-optimal, but it will be an equilibrium that is optimal not in terms of what we really want, but optimal instead in terms of our tastes. Standard economics ignores this difference because most economists assume that people know what they want.”

According to Akerlof, while free markets fulfill material desires and consumer tastes, they can also harm consumers by exploiting their psychological weaknesses. Specifically, markets take advantage of offering products related to four things: personal financial insecurity, financial and macroeconomic instability, ill health and bad government.

Under Akerlof’s theory, free markets only truly benefit consumers when there are no external incentives for businesses.

“Free markets only provide us what we want if we, human machines, make the right choices. If we have some weakness, that weakness will be targeted if there’s a profit to be made,” Akerlof said. “As a result, we have a phishing equilibrium, in which every chance for a profit more than the ordinary will be taken.”

Akerlof said these ideas are often ignored by economists.

“I believe that ‘Phishing for Phools’ is one of those holes in economics. Because all economists know it, it cannot be published, and because it cannot be published, it gets ignored,” Akerlof said. “Because it was ignored, we have the financial crisis and that’s the central event in the economic history of our time.”

According to Akerlof, the financial crisis was shaped by weak national policy.

“A wrong-minded U.S. national story about economics, which is that everything will be alright if the government steps out of the picture and we just let people be free to choose, has resulted in systematic bad policy,” Akerlof said.

The market in which businesses profit off the psychological desires of consumers fuels the present-day capitalist model.

“Life in a capitalist economy is a continual temptation,” Akerlof said. “Just walk down a city street. Shop windows are literally there to make you come in and buy. The idea of tempting consumers to buy is at the heart of capitalism.”

Akerlof said this conception of capitalism contributed to the 2008 financial crisis.

“‘Phishing for Phools’ gives us an extremely succinct explanation for what happened,” Akerlof said. “If I have a reputation for selling perfect avocados, I have an opportunity. I can sell you rotten avocados at the price you would pay for the perfect ripe ones. I will have mined my reputation but I also will have phished you for a fool.”

According to Akerlof, the reputations of big ratings agencies, such as Moody’s and Standard and Poor’s, had been built up for almost a century. Even though bonds and securities became more complex, and more challenging to rate accurately, the public continued to rely on the agencies’ ratings because of their prior reputation.

Akerlof said these inaccurate ratings — supported by stable reputations — led banks to borrow too much money using unstable securities as collateral.

“The value of the securities reflected by the ratings, enabled commercial banks, investment banks and hedge funds to borrow huge amounts of money. That borrowing was made with the rotten securities as collateral,” Akerlof said. “When the truth was discovered, what we saw from Frankfurt to New York to Reykjavik was that financial institutions owed much more than they owned. Without bailout, they were bankrupt.”

Carroll Round Programming Chair Duy May (SFS ’18) said the Carroll Round was pleased to host Akerlof in a more informal setting.

“Dr. George Akerlof is a thought leader in the field of economics and the Carroll Round is honored to host Dr. Akerlof again — this time in a more informal and intimate setting with the Georgetown community. With the presence of an engaging audience, the event went well as expected,” May wrote in an email to The Hoya.

Kelsey Harrison (SFS ’18), who attended the event, found Akerlof’s economic diagnosis to be thought-provoking.

“I thought it was especially interesting to hear about the narrative part, about the stories people tell in economics,” Harrison said.