Financial intelligence and anti-corruption industry professionals stressed the grave extent of the United States’ money laundering problem and detailed extensive illicit financing networks at an April 4 colloquium held by Georgetown University’s Landegger Program in International Business Diplomacy (IBD).

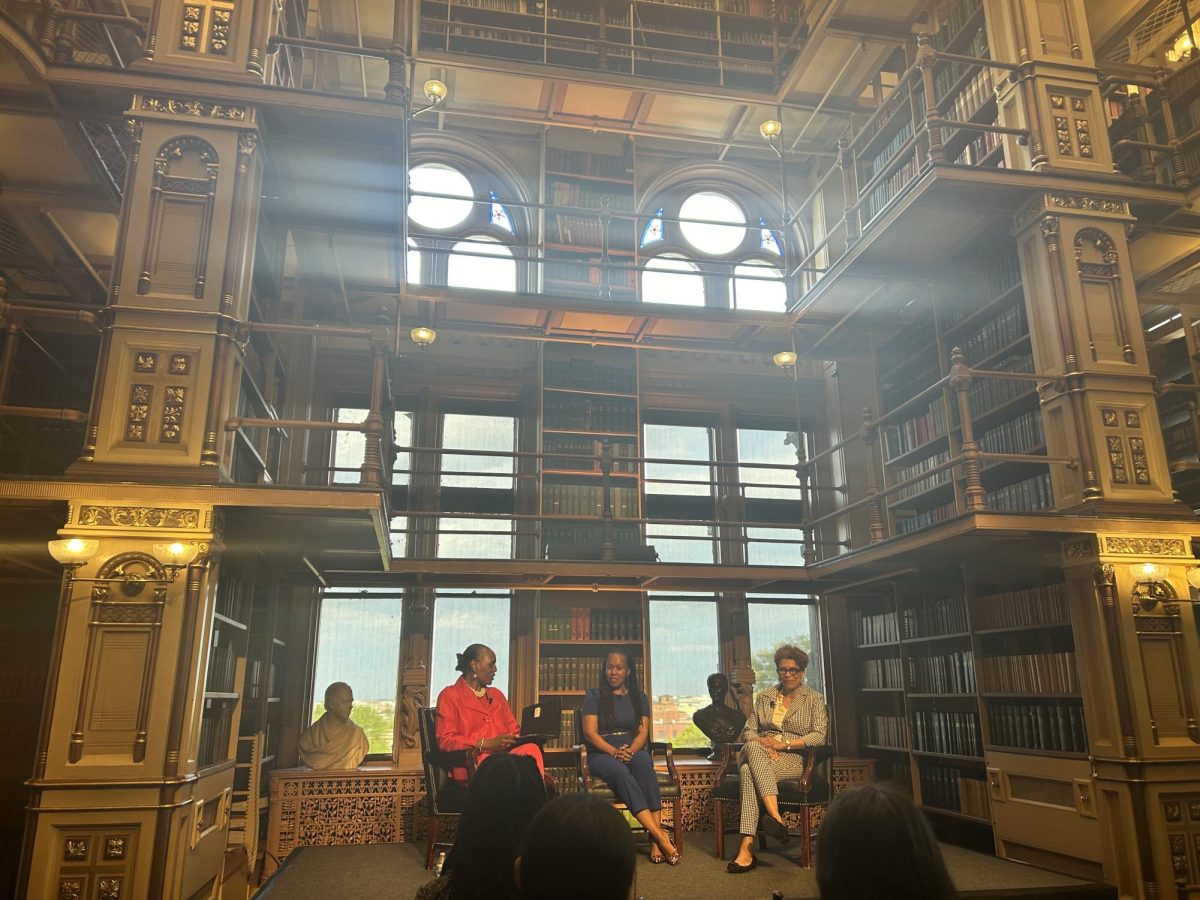

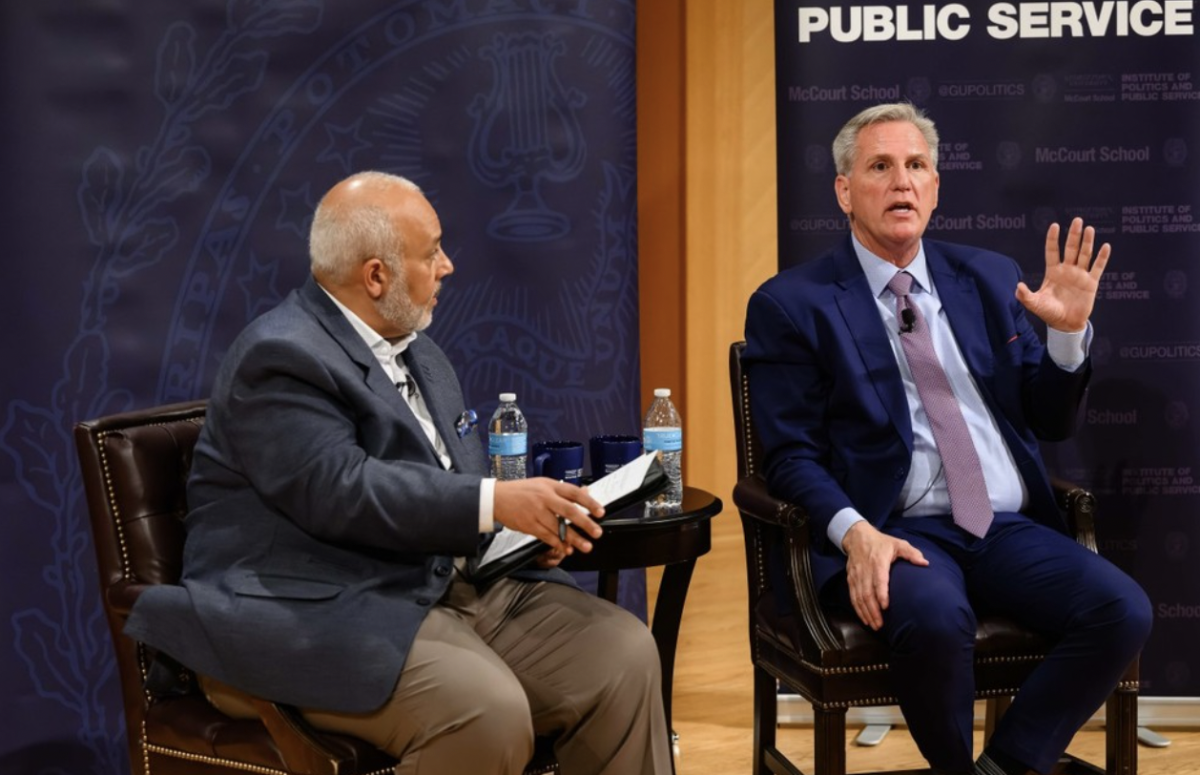

The Landegger Program, a School of Foreign Service (SFS) program that focuses on the intersection of international public and private sector activities, hosted its inaugural Mody Colloquium on Illicit Finance and Corruption, which centered on the theme “Professional Enablers of Illicit Finance.” At the event, Brian Nelson, the United States undersecretary of the treasury for terrorism and financial intelligence, delivered a keynote event on money laundering in the American financial system and the Biden-Harris administration’s efforts to combat the issue, while a panel of private sector and non-profit industry professionals focused on illicit finance.

Rodney Ludema, director of the Landegger Program and chair of the department of economics, said the Mody Colloquium can help prepare students for future careers by giving industry experts a platform to talk about the landscape of illicit finance.

“The mission of the IBD Program is to prepare students of international affairs for careers at the intersection of the public and private sectors,” Ludema said at the event. “Today’s event, the first annual Mody Symposium on Illicit Finance and Corruption, is meant to shine a spotlight on what we are doing here by bringing in experts in the field to talk about the latest developments in the fight against illicit finance.”

In his keynote address, Nelson said dangerous actors have historically used the American financial system for criminal activity.

“For decades, we have seen a panoply of dangerous actors, from terrorist financiers to human traffickers, fraudsters and U.S. adversaries, taking advantage of regulatory gaps in our financial system to move dirty money through the United States,” Nelson said at the event. “That is why our regulatory agenda seeks to detect and deter illicit financial activity, address vulnerabilities that exist in our financial system and shield our economy from criminal exploitation.”

Panelist Alexandra Gillies, director of the Organized Crime and Corruption Reporting Project (OCCRP), a global investigative journalism organization, said ‘enabler’ firms that support illicit financing provide secrecy and protection for those looking to store so-called “dirty,” or illegally gained or utilized, money.

“What services are these enablers providing?” Gillies said at the event. “They were helping their oligarchs to avoid scrutiny, to keep their name off the paperwork. Basically, they were selling secrecy.”

Scott Greytak, director of advocacy at Transparency International U.S., a global anti-corruption advocacy organization working in over 100 countries, said officials who steal money invest considerable resources in protecting that money within Western financial systems, keeping their networks of corruption intact.

“If you’re a corrupt official in another part of the world, and you’re stealing money from your people, you’re literally embezzling it, or you’re taking bribes to turn a blind eye to how they destroy your environment,” Greytak said at the event. “Those officials don’t want to keep that money under their mattress. They want it to grow and they want it to be safe. They want to move it into a Western financial system.”

“This isn’t just folks who are taking a bribe or embezzling some money,” Greytak added. “This is literally the money that keeps networks like Putin’s oligarch network together.”

According to a 2022 report by the Tax Justice Network, a tax transparency advocacy group focusing on tax avoidance, competition and havens, the United States is the number one location for money laundering. The United States accounts for nearly 6% of the world’s financial secrecy, or the use of financial mechanisms by corporations and criminals to hide their assets and evade the law.

Panelist Tom Firestone, a financial crime litigator, said the United States’ rigorous standards for prosecuting money laundering crimes offer a strong safety net against illicit financial practices.

“Courts, juries, prosecutors look at all the telltale signs that somebody is dealing in dirty money, and that is the basis for criminal prosecution,” Firestone said.

Nelson said that private, nonprofit and governmental organizations should work together to deter illicit financing and corruption.

“When we work together, we can be more effective in our common goal of protecting the U.S. financial system,” Nelson said.

“Our message is very clear: The United States is not a haven for dirty money, criminals cannot abuse America’s thriving housing market or investment advising sector for nefarious purposes and our financial system cannot create a corporate ecosystem that facilitates crime,” he added.